When you notice a dip in the living room or hear unsettling creaks underfoot, the first thought is often about repair costs. But before hiring a contractor, most homeowners wonder: sagging floors insurance-does my policy actually pay for it? This guide breaks down what a sagging floor is, when insurance steps in, and how to navigate a claim without hitting dead ends.

What a Sagging floor is

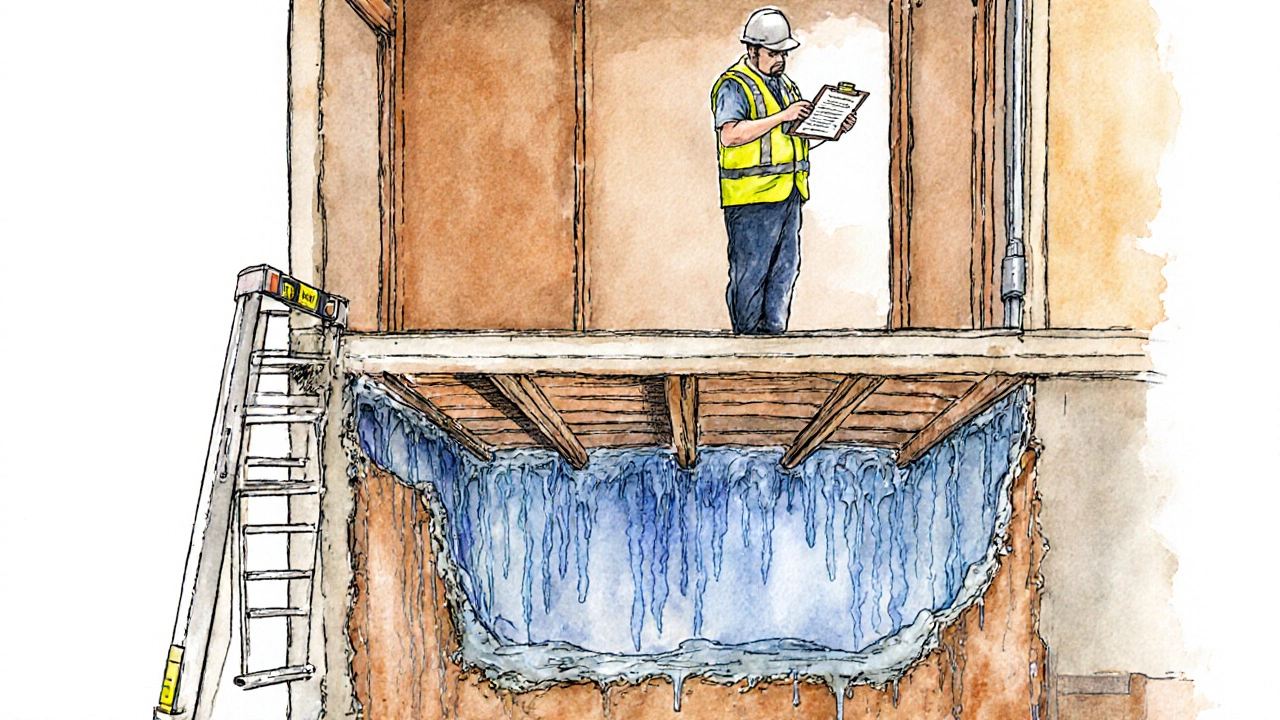

A sagging floor describes a situation where the floor surface drops or becomes uneven because the underlying structure has shifted. The movement may be gradual, showing as a few centimetres of dip, or it can be sudden after a heavy load. Common signs include visible gaps between floorboards, doors that won’t close properly, and persistent creaking noises.

How typical home insurance works

In the UK, home insurance is split into two main parts: content insurance (covers personal belongings) and building insurance (covers the physical structure). Building policies generally protect against "perils" like fire, flood, and wind damage. Structural issues such as a sagging floor sit in a gray area because they can stem from both accidental damage and gradual wear.

When building insurance may cover structural damage

Most standard building policies include a clause for "sudden and accidental" damage. If a sagging floor is caused by a covered peril-say a burst pipe that floods the joists-your insurer will likely pay for the repair. However, if the cause is slow‑moving settlement of the foundation, the policy usually treats it as a maintenance issue, which is excluded.

Common causes of floor sagging and who’s liable

- Foundation settlement: soil shrinkage, poor compaction, or tree root growth can cause the foundation to shift over years. This is typically considered wear and tear, not an insured event.

- Water ingress: leaking roofs or burst pipes saturate timber joists, leading to rot and loss of strength. Most policies treat this as accidental damage.

- Overloading: storing heavy items on a single spot can deform floor joists. Insurers often view this as user‑error, excluded from coverage.

- Construction defects: errors by a builder or contractor may be covered under a warranty rather than insurance.

Policy exclusions that bite

Understanding the fine print can save you months of frustration. Typical exclusions relevant to sagging floors include:

- Gradual wear and tear

- Soil movement not caused by a covered event

- Improper maintenance or DIY repairs

- Damage due to pests (e.g., termites) unless specifically added

If your policy lists any of these, you’ll likely need to fund the repair yourself or rely on a builder’s warranty.

Step‑by‑step claim process for a sagging floor

- Document the issue: take clear photos, note measurements, and record when the problem first appeared.

- Contact your insurer: use the dedicated claims line and provide the policy number, a brief description, and your documentation.

- Request an assessment: the insurer may send a surveyor to determine cause and extent. It’s wise to be present during the visit.

- Receive a written decision: the insurer will state whether the damage is covered, partially covered, or excluded.

- If approved, obtain quotes from at least two reputable building contractors and submit them for approval.

- Proceed with the repair and keep all receipts. Submit final invoices to the insurer for reimbursement.

Should the claim be denied, you have the right to appeal. Gather independent expert opinions-often a structural engineer’s report can overturn an exclusion decision.

Preventive measures and documentation tips

Preventing a sagging floor is cheaper than fighting an insurance battle. Here’s what you can do:

- Schedule a regular building survey (every 5-10 years) to catch early settlement.

- Maintain proper drainage around the house; ensure gutters and downspouts direct water away from foundations.

- Avoid storing excessively heavy items on single joists-spread the load.

- If you discover a defect during renovation, keep all contracts and warranties. These documents can support a future claim or legal action.

Comparison of common insurance options for structural issues

| Insurance Type | Typical Coverage for Sagging Floor | Exclusions | Average Annual Premium (UK) |

|---|---|---|---|

| Standard Building Insurance | Covers sudden accidental damage (e.g., burst pipe) | Gradual settlement, wear and tear, DIY errors | £200‑£350 |

| Specialist Structural Damage Cover | Includes foundation movement caused by extreme weather | Excludes pre‑existing defects, pest damage | £350‑£500 |

| Builder’s Warranty (10‑year) | Covers construction defects from the original build | Doesn’t cover post‑warranty settlement | Typically built‑in, no separate premium |

| Homeowner’s Contents & Liability Only | None - focuses on personal items, not structure | All structural issues | £100‑£180 |

Choosing the right policy depends on your home’s age, local soil conditions, and how much risk you’re willing to self‑fund. For older properties in areas with known ground movement, adding a specialist structural cover can be a smart move.

Frequently Asked Questions

Will my standard building insurance pay for a sagging floor caused by a leaking roof?

Yes, if the leak is sudden and leads to water damage of the joists, most policies treat it as accidental damage and will cover the repair costs after an assessment.

What evidence do insurers need to approve a claim for a sagging floor?

Insurers typically request clear photographs, measured dip depths, a written report from a qualified surveyor or structural engineer, and proof of regular maintenance (e.g., drainage records).

Can I add coverage for foundation settlement to an existing policy?

Many insurers offer an add‑on called “structural settlement cover” or “ground movement protection.” It usually costs an extra £50‑£100 per year and expands coverage to gradual ground movement.

If my claim is denied, what are my next steps?

First, request a written explanation. Then, obtain an independent engineer’s assessment and submit a formal appeal. If the insurer still refuses, you can lodge a complaint with the Financial Ombudsman Service.

Is a builder’s warranty a substitute for insurance?

A builder’s warranty covers defects arising from the construction process for a set period (often 10 years). It does not replace insurance for accidental damage like burst pipes or fire.